Settlements in Queensland Conveyancing... How Does it Work?

Conveyancing of property sounds complex. We cover the conveyancing process through to Settlement to help you understand what happens if you have a purchase or sale contract which has now gone unconditional.

Your Lawyer/Conveyancer has a bit of work to do before the Property is settled.

Searches

Most law firms will have provided a search list with a large array of relevant, and irrelevant searches that you can undertake to know more about the property you are buying.

If we have had an opportunity to review the Contract with you prior to signing, most of the time we will have recommended that the searches be undertaken, received and reviewed prior to the Contract going unconditional (for a purchase).

In many cases however, clients may be well informed, or happy enough to proceed without the need of searches prior to dates such as Finance, Building & Pest or other conditions. In this case, your lawyer might look to ensure that all searches are undertaken or received shortly following the unconditional date of the Contract, so that they are received well prior to Settlement. Some searches are quite relevant to Settlement as your lawyer will look to base their Settlement Adjustments on the search results, such as Rates, Water Usage and Land Tax searches.

Transfers

Queensland is mandating electronic conveyancing in 2023, meaning almost all settlements will be required to be undertaken digitally. Historically, one of the key elements of Settlement was ensuring that the Transfer of Land had been received back from the Seller and was in the correct form. These days, it’s far more common for law firms to take authority from their clients to execute the Transfers digitally, on the client’s behalf. If a law firm requires a physical transfer for any reason, they will want to ensure this is back and signed correctly well ahead of Settlement.

The Workspace

With almost all of our Settlements occurring digitally already, we will only touch on Electronic Conveyancing for the purposes of this article.

Bradley + Bray are proud supporters and early adopters of the PEXA exchange platform; you might commonly hear this referred to by your lawyer as ‘the Workspace’.

Basically, this is a digital space that both party’s lawyers, the banks, settlement agents and other represented parties can collaborate together and work on the same Settlement in a transparent, yet secure platform. Your lawyer will generally start setting up the workspace quite early in the matter, inviting the Banks to join to ensure they are ready to either release the mortgage, or provide the money to settle long before they are needed to.

In readiness for Settlement, your lawyer will be preparing the transfer documents, communicating with the other parties to ensure they are ready, adjusting Settlement figures, creating destination lines for the payment of the Purchase Price to the Seller (these used to be called ‘cheque directions’), completing the Queensland Revenue Office transfer duty lodgement, calculating lodgement fees, or a range of different tasks in readiness for the Settlement Date.

Settlement Figures

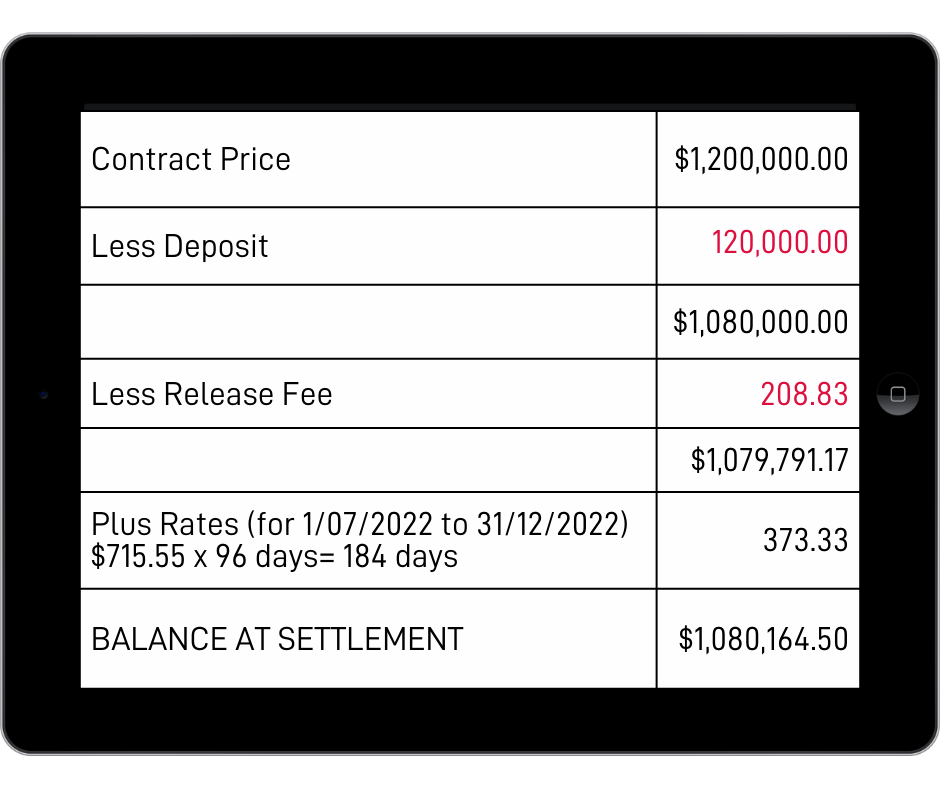

Many firms will continue to prepare Settlement Adjustments in a schedule outside of the Workspace. Using the searches that the Buyer undertook (rates, water, land tax etc.) the lawyers will prepare adjustments to either compensate the Buyer for a future liability that will be incurred that the Seller owes some part of or compensate the Seller for something they have paid earlier, that the Buyer will receive the benefit of. For example, if the Seller has paid the rates up to December 31st and the Buyer is taking the Property over in September, the Buyer should have to compensate the Seller for the rates they have paid in advance.

You can adjust all kinds of expenses, some might include:

- Less adjustments for the Mortgage Release fee;

- Adjustments for Rates, Water, Land Tax;

- Negotiated adjustments as part of a Building & Pest negotiation;

- GST in certain circumstance (i.e. for commercial properties);

- Rent; or

- Bond (i.e. for Commercial Properties where bond is not held by the RTA).

If the Seller owes a liability to another entity, such as unpaid taxes which are the subject of a Notice on title, or their selling agent, these expenses will generally form part of the Seller’s destination lines (or Seller’s Cheque Directions). The easiest way to think about this is:

The adjustments are the outgoings and costs that we need to balance between the parties to get to the final Purchase Price;

2. From the Purchase Price, the Seller advises how they want that purchase price split up, which might look something like this:

Settlement Figures are finalised between the party, and then inserted into the Workspace, so the incoming bank knows how much money to provide.

If there is a shortfall, your lawyer will usually get in touch early to get additional funds from you to place into their trust account in readiness for Settlement.

Pre-Settlement Inspection

Not something your lawyer does for you, but something we suggest you undertake. A Pre-Settlement inspection is a good way of ensuring that if there are any last-minute issues, they can be dealt with before the money is handed over. For example, if the Contract stipulated that a fridge and washing machine was part of the purchase price, however the Seller has taken these items, a Pre-Settlement Inspection is a good time to identify with your lawyer that those items are missing so the matter can be swiftly dealt with before Settlement.

Settlement Time

Once the Settlement figures are agreed, all parties have accepted the invitations to participate in the workspace, the incoming bank has uploaded their source funds (the money needed to settle), the outgoing bank as uploaded their pay out figure, we are almost right to settle!

Each party will need to sign off on the Settlement confirming that the details are all true and correct, and Settlement can proceed. Once all parties have done this, the Workspace will lock at the Settlement time, and a few processes will start occurring, such as:

- Funds being transferred from the Source Funds to the Payment Destinations;

- Transfers, Release of Mortgages and other forms to be sent directly to the Land Titles Office;

- Queensland Revenue Office will receive their Transfer Duty and duty payment information; and

- The status of the matter will change to ‘settled’.

This provides a short summary of some of the main aspects of a conveyancing settlement. There are many more processes that take place behind the scenes (i.e. GST Withholding Certificates, deposit releases, Notices of Attornment etc) that we have chosen not to elaborate on in this article for simplicity.

Your conveyancers and lawyers have many moving targets to address as part of the Settlement of your home, which is often why conveyancing can feel like a very ‘systemised’ process. These systems help all parties ensure that nothing gets missed along the way, and you move into your home stress free!

This blog is intended to be for general information only, and is in no way a substitute for receiving legal advice when buying or selling property in Queensland. Bradley & Bray does not intend to provide any legal advice under this article. We recommend all people buying or selling property to receive legal advice prior to signing any document.